If UK breweries could make a wish, they would likely ask, “People throughout the Kingdom, please drink more beer!”

Wait, maybe they already have.

Please stay with me for a moment, I do intend to dive into profitability of the UK beer industry but am prone to a whimsical introduction.

UK Beer Sales Are Increasing

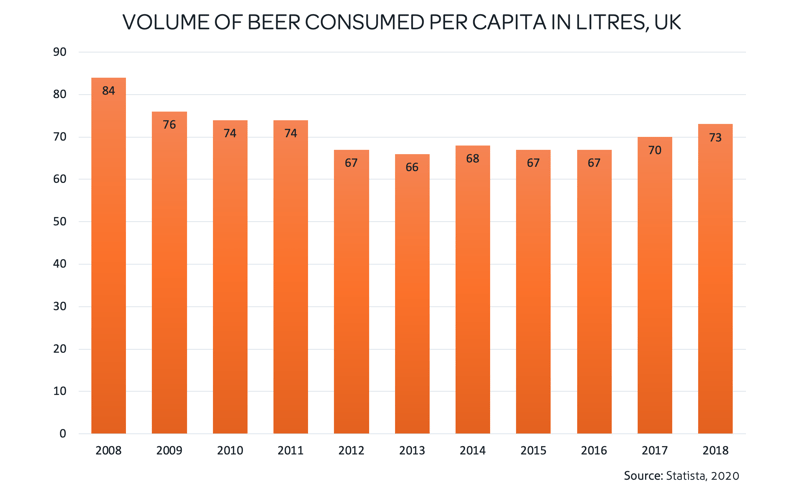

Sales of beer in the UK have been on the climb over the past few years after significant decreases starting in 2009 according to Statista.

According to the Telegraph in 2018, the UK stood in twenty-fifth place globally in per capita consumption by country. In volume the same year, the Kirin Holdings Company, Limited reported that the UK ranked number eight in the world with good weather and a World Cup driving an increase of 5.7%.

But the times, they are a changing. Britons are changing where we buy, what we buy and even how we buy. How does that effect breweries and are they preparing or already well prepared for the changes?

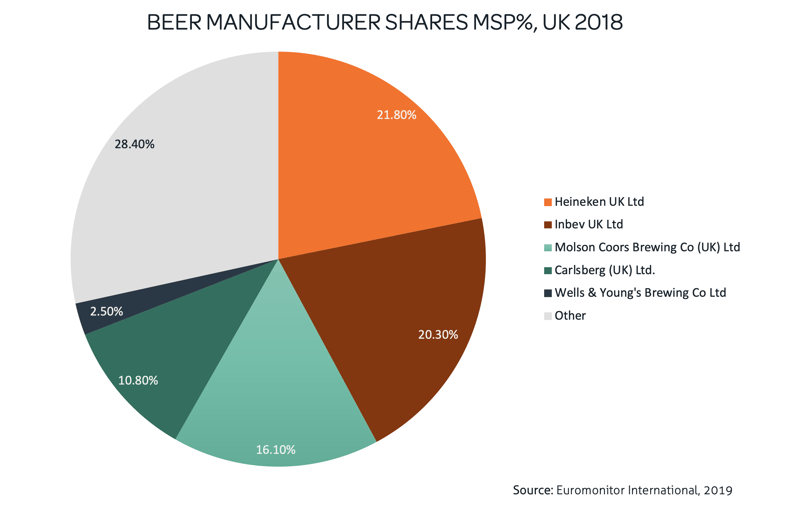

The numbers above show that in 2018 more than 68% of our beer was produced by the top four brewers. According to Carling Partnership, by 2019, 80% of Britain’s beer came from these same four producers.

So, what is changing you ask?

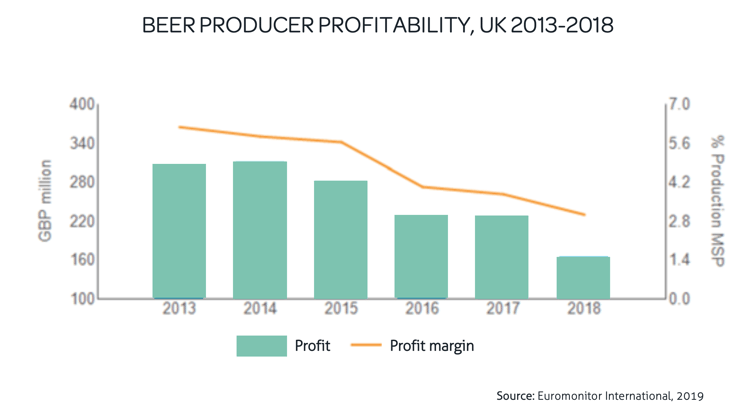

In a word, profitability.

Sales volume is up but profitability is down. What’s the underlying cause?

There are some interesting consumer trends driving industry profitability with profound effects:

- UK consumers are buying dramatically more beer in supermarkets and convenience stores.

Supermarkets and convenience stores are offering price reductions to entice us to their locations. Price reductions mean profit reductions. - UK consumers are buying more beer online.

Susanne Currid, London advisor for “The Business of Drinks”, states, “US research from The Harris Poll (2017) indicates that beer accounts for 29% of online alcohol sales. UK consumers are also reported to be three times more likely to buy alcohol online than the global average. We actually lead the European market in online alcohol sales.” Yes, we are buying more beer online and more food. That means an added market for breweries to chase and once again pricing can be a leading factor. - UK consumers are buying more beer in cans.

Because of the shift to the two purchasing methods above, cans have become more convenient packaging. When plants have to switch lines from bottles to cans and back again take on added costs in time lost in production.

So how do the breweries continue to meet the demands of their shareholders or owners?

They search and prepare for these market changes and they set goals which almost always include becoming more efficient. Gains of six to eight percent production efficiency means a great deal to large brewers.

Think of your own operation. What if you could improve production by six to eight percent or more?